Clients and friends of our firm:

We’re closely watching the spread and impact of the Coronavirus. Over the weekend, the death toll from the virus climbed to 81 from just 25 on Friday morning. The number of confirmed cases in China rose to nearly 3,000 with another 30,000 under observation. A further concern is that the Chinese government is grossly under-reporting the true number of infected people, either purposely or through an inability to get an accurate count. Further, an estimated five million people left Wuhan Province, where the virus originated, before the area could be quarantined. Where are those people now? Some of them traveled abroad. Outside China, cases have now been confirmed in 16 nations. In the United States there were three new confirmed cases over the weekend, bringing the total number to five. Another 110 people are under observation and being tested for the virus.

Separating the Known from the Unknown

Clearly, further spread of the disease and the resultant impact on the global economy bears close inspection. If people are afraid to travel and conduct business, it’s going to negatively impact the global economy. Airlines, cruise lines, hotels etc. are the most obvious immediate victims. All are seeing their stock prices sharply decline today. Looking more broadly, perhaps the best model we have for what may happen in the coming weeks is the SARS outbreak in the Winter of 2002 / ’03. Although only about 800 people died worldwide due to SARS, the spread and fear (mostly the fear) of the disease had market implications that were disproportionate to the actual number of people who ultimately contracted and died. As this week progresses, we expect increased media attention on the Coronavirus outbreak, travel restrictions, perhaps closed borders, and shaken confidence in the global economy.

In the SARs example, the world economy and markets initially suffered, but within a matter of months the markets shrugged off fears of pandemic. Six months after the initial outbreak the S&P 500 was more than 10% higher than at the onset of the SARS outbreak. Will the Coronavirus impact follow a similar path? We’re tracking closely.

Our Positioning

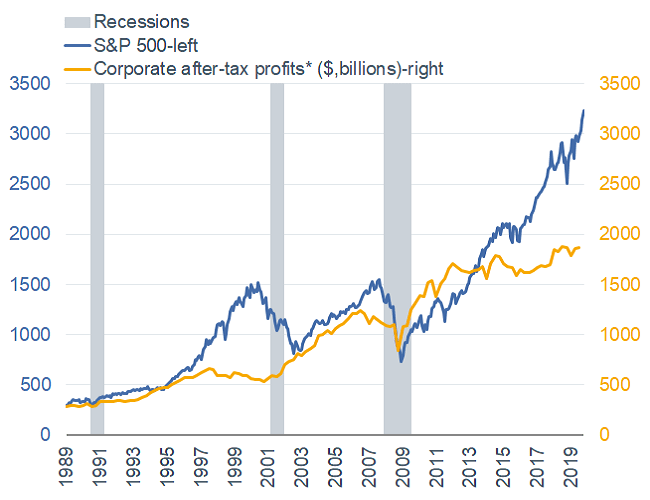

Please pardon our callous analysis as you read on. We recognize the spread of this disease is truly a life death matter, but our job is to focus coldly on the potential impact on our clients’ financial well-being. With that said, we find ourselves well positioned to weather a potential market shock. After a very rewarding 2019, we took profits through late 2019 and the first weeks of 2020. As a result, we find ourselves with the most conservative positioning and the highest level of cash we have had in years. Unrelated to the Coronavirus situation, we have been watching closely the relationship between the rapidly rising stock market and somewhat anemic corporate profit growth. As you can see on the attached chart, the S&P 500 (blue line) has risen sharply while corporate profits (yellow line) have only inched ahead. The relationship simply doesn’t work this way. Ultimately, something has to give. Either profits must rise to keep pace (and they may), or the market must decline to get back in balance. The last time we saw a disconnect of this magnitude was in the late 1990’s driven by the Tech Bubble. In that case it was the stock market that gave in and declined in order to reestablish synergy. Will that be the path this time? To be clear, we’re not making that call at this point. Many of the conditions that applied to the late 1990’s are not present in the current market. Still, the timing of the Coronavirus may give the market an excuse to sell off and perhaps reestablish a cleaner correlation. We will be watching closely.

Opportunity?

In summary, we find ourselves in an envious position. We have an extreme and unusually high amount of uncommitted cash in our client’s accounts at this point. Near term, it serves as a safety net. If we believe that the Coronavirus will follow a similar path as the SARS scare from 17 years ago, we will be able to methodically commit our cash to our target investments at more compelling pricing. We’re not in an immediate rush to do that, but will remain watchful and opportunistic.